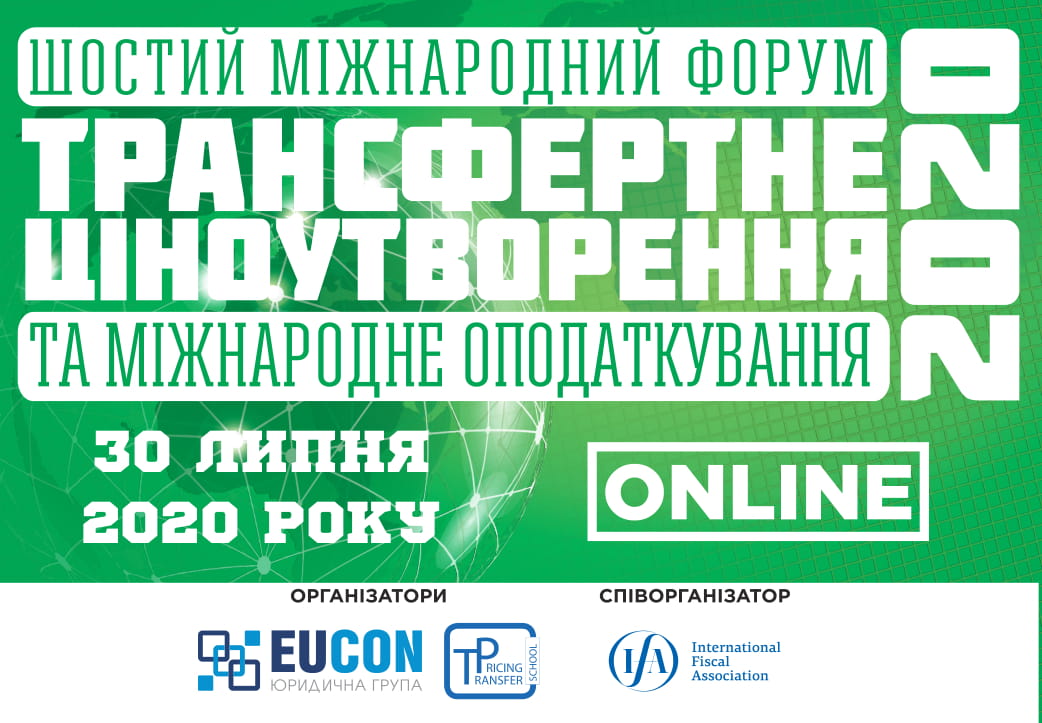

On July 30 the EUCON Legal Group and the Transfer Pricing School with the International Fiscal Association Ukraine, having accepted the challenges and adapted to the new conditions, organized the VI International Forum “Transfer Pricing and International Taxation – 2020”, which was held online for the first time. For six years of productive work, the event has become one of the main platforms in Ukraine for discussing and analyzing the transfer pricing industry, as well as a mouthpiece for new ideas and expert opinions in promoting the development of transfer pricing.

Representatives of the State Tax Service, leading auditors, lawyers, attorneys, judges, representatives of the Ministry of Finance of Ukraine and Business during the eight hours of the forum discussed important issues of the current state of the implementation processes in Ukraine of certain provisions of the BEPS plan; new approaches of the state in organizing control in the field of transfer pricing; inspecting the innovations in 2020 and the prospects for other expected changes; the consequences of the ratification of the agreement between Ukraine and the United States on the implementation of FATCA; details of the start of the processes of exchange of information on financial accounts of non-residents according to the international CRS standard as part of the implementation of the BEPS plan in Ukraine; application of transfer pricing rules as a tool for planning business processes; quality criterion for the preparation of documentation through the prism of inspections and comments of regulatory authorities case studies of recent arm’s length audits; the latest judicial practice, etc.

The forum was opened with a welcoming speech by the Attorney-at-Law, Managing Partner of the EUCON Legal Group, Yaroslav Romanchuk, who noted the activity of legislative changes in the tax area and outlined the range of issues that will be discussed during the forum.

In addition, the managing partner of EUCON became the moderator of the first panel discussion „Global deoffshorization and global tax rules: how do they and will affect the tax system of Ukraine and transfer pricing, in particular?“

First Deputy Head of the State Tax Service of Ukraine Natalya Ruban, outlining the activities of the STS, noted the vectors of work in the direction of strengthening the control of international transactions, controlled foreign transactions, noted the mistakes made when drawing up reports with transfer pricing, considered the issue of income tax, budget revenues from transfer pricing, changes in the Tax Code, etc.

Ruslan Lazarenko, public finance advisor of the German Society for International Cooperation GIZ Ukraine, spoke about international tax processes, the exchange of tax information, steps to implement the BEPS plan, events for partners from GIZ, etc.

President of the Association of Taxpayers of Ukraine Grigol Katamadze, in turn, noted the dynamics of positive changes in the work of the State Tax Service, highlighting the aspects of establishing communication between business and tax authorities. Also, Mr. Katamedze highlighted the issue of creating the Financial Investigation Service as an urgent need in the context of the realities of reforming the tax system.

Head of the Transfer Pricing Department of the Tax Audit Department of the State Tax Service of Ukraine, Vladimir Vargich, emphasized the presence of good dynamics in making adjustments to the reporting, improving financial results, focusing also on the process of carrying out inspections of the State Tax Service.

The second session “International Tax Trends – 2020. New Rules of the Game for Ukrainian Business in an International Context” became the equator of the VI International Forum “Transfer Pricing – 2020”, moderated by Larisa Vrublevskaya, an auditor, partner, head of the transfer pricing practice of the EUCON Legal Group.

Lyudmila Ponomar, Head of the International Taxation Department of the Tax Policy Department of the Ministry of Finance of Ukraine, told the participants about the preventive measures of the Ministry of Finance and its cooperation with the OECD, about amendments to the legislation as part of the implementation of the BEPS plan.

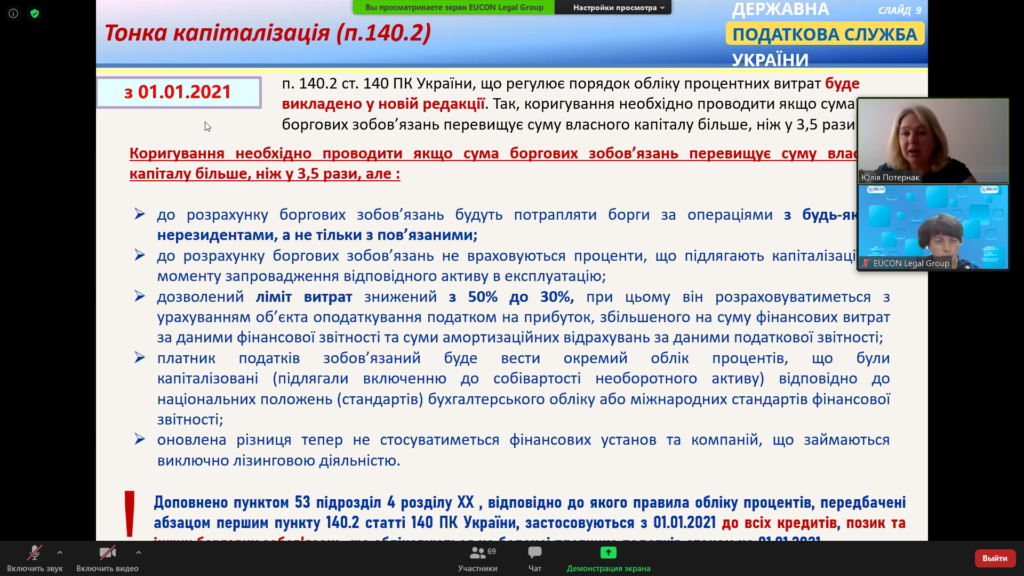

The head of the department for audits of financial transactions of the State Tax Service of Ukraine, Yulia Poternak, within the framework of the topic „Analysis of amendments to the Tax Code of Ukraine on international taxation“ spoke about amendments to the legislation and the limits of their implementation, constructive dividends, thin capitalization, etc.

Expert of the Council of the National Bank of Ukraine Yevhen Stepanyuk focused on the issues of Ukraine’s accession to agreements on international exchange of tax information, organization of the process on the part of Ukraine and other counterparty countries, information protection, etc.

Particularly informative and rich in statistical data was the speech of Maxim Vasyuk, Head of the Department of Financial Investigations of the State Financial Monitoring Service of Ukraine, who reviewed typical money laundering schemes using foreign jurisdictions, issues of financial monitoring, complex investigations of multi-stage corruption of officials, etc.

Member of the Board of the International Fiscal Association Ukraine Pavel Khodakovsky raised the topical issue of the concept of a business goal, the prerequisites for its introduction, the peculiarities of the interpretation of the new law and the controversial nature of this definition.

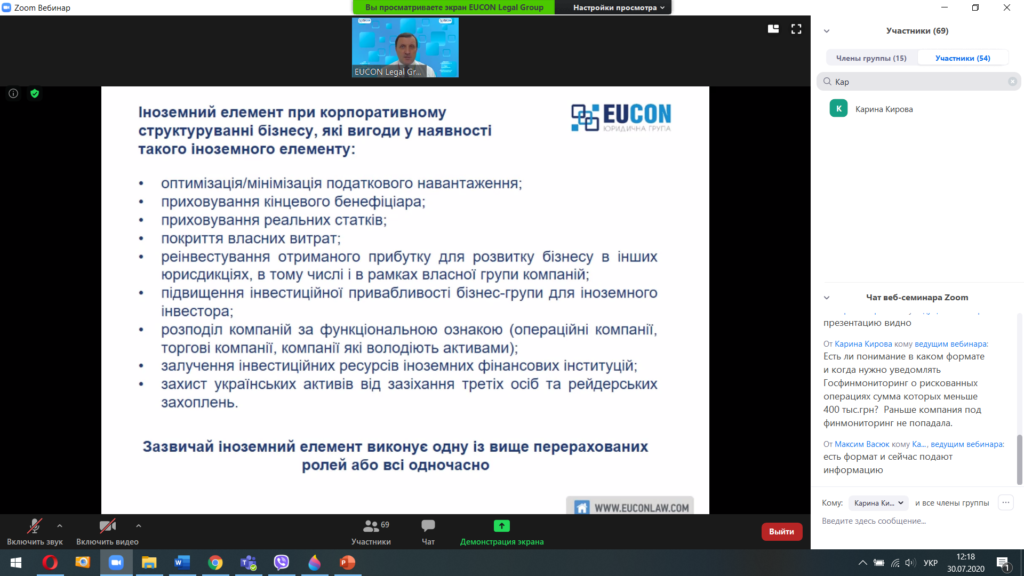

Yaroslav Romanchuk, in turn, considered Ukraine’s accession to BEPS, MLI, FATCA and CRS, legislative innovations for the implementation of primary financial monitoring, classification of offshore companies, the purpose of using offshore companies in restructuring and alternatives to offshore companies after their “death”.

The participants of the third session, „Effective Strategies for Minimizing Tax Risks: Practical Aspects“, focused directly on the consideration of transfer pricing issues.

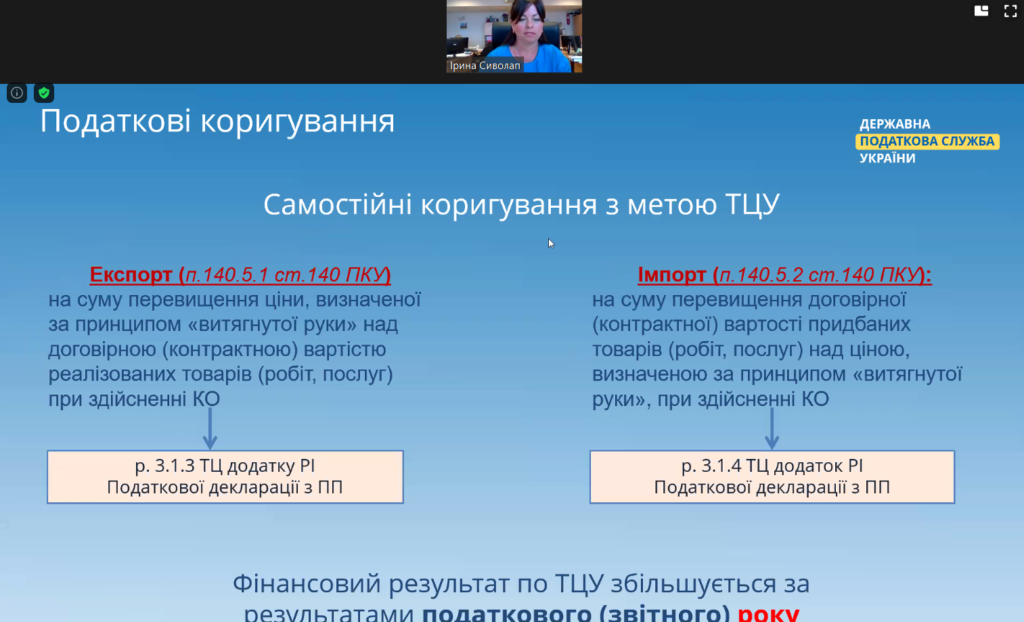

Irina Sivolap, the head of the profit tax administration department of the profit tax administration department, non-profit institutions and organizations and the simplified system of the Tax Administration Department of the State Tax Service of Ukraine, spoke about tax adjustments, independent adjustments for the purpose of transfer pricing, as well as examples of inadequate tax efficiency.

Yuriy Gladun, Advisor on Tax and Customs Issues of the German-Ukrainian Chamber of Commerce and Industry, spoke about the legislative basis for the exchange of tax information in the context of transfer pricing, the types and procedure of exchange, reports in the context of the countries of the international group of companies.

Larisa Vrublevskaya’s speech covered the issues of reporting in the field of transfer pricing for 2019, the main errors in the preparation of reports, inventory of controlled transactions, risks in calculations, transfer pricing documentation, etc.

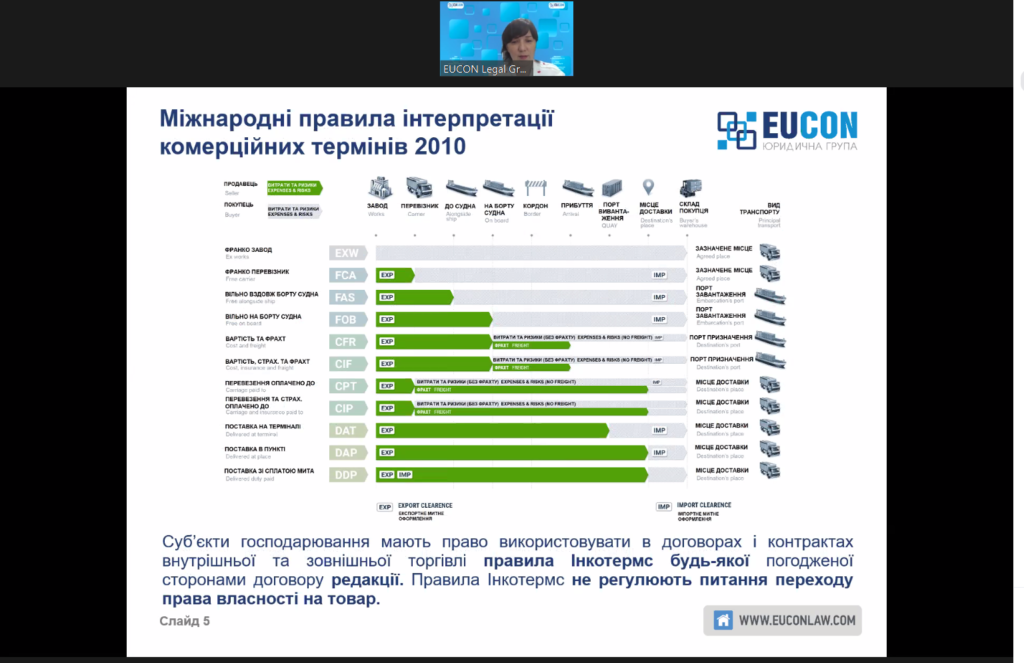

Zhanna Biloblovskaya, an auditor and adviser to the EUCON Legal Group, told the participants about the specifics of recognizing controlled transactions depending on the chosen delivery basis, in particular, about liability for late declaration, examples of application of Incoterms rules, etc.

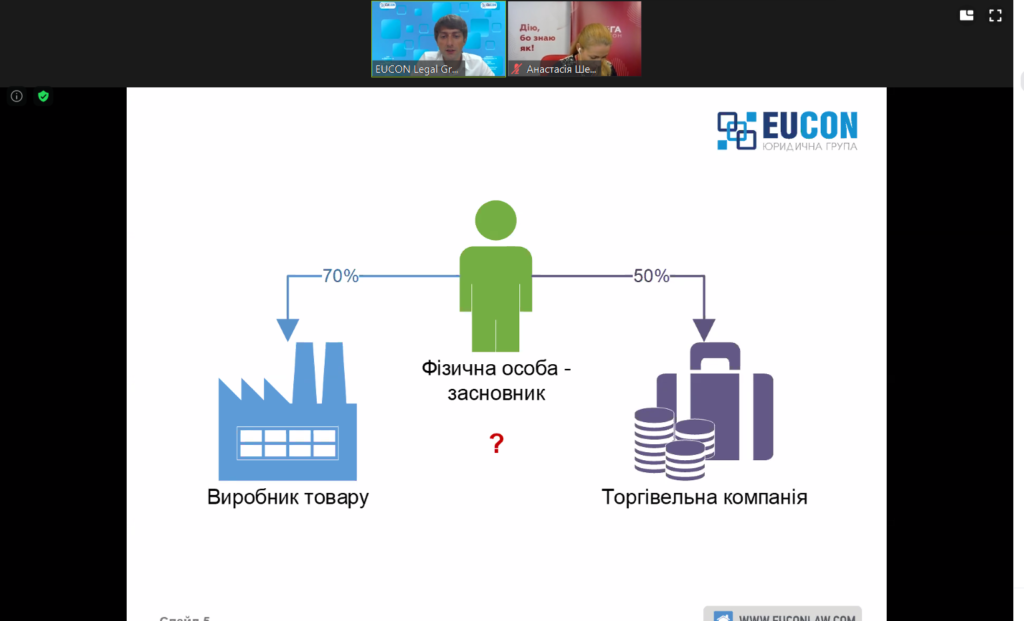

Counselor, tax consultant, deputy head of the transfer pricing practice of the EUCON Legal Group, Yuriy Chebotar, under the topic “Selection criteria for comparable legal entities” considered the algorithm for analyzing a controlled transaction, a typical selection process, the most used criteria, etc.

The final chord of the event was the fourth session “Control over transfer pricing – the results of an audit by tax authorities. Judicial Practice”, moderated by the head of the Center for Legal Analytics LIGA: ZAKON, Candidate of Political Science Anastasia Shevchenko.

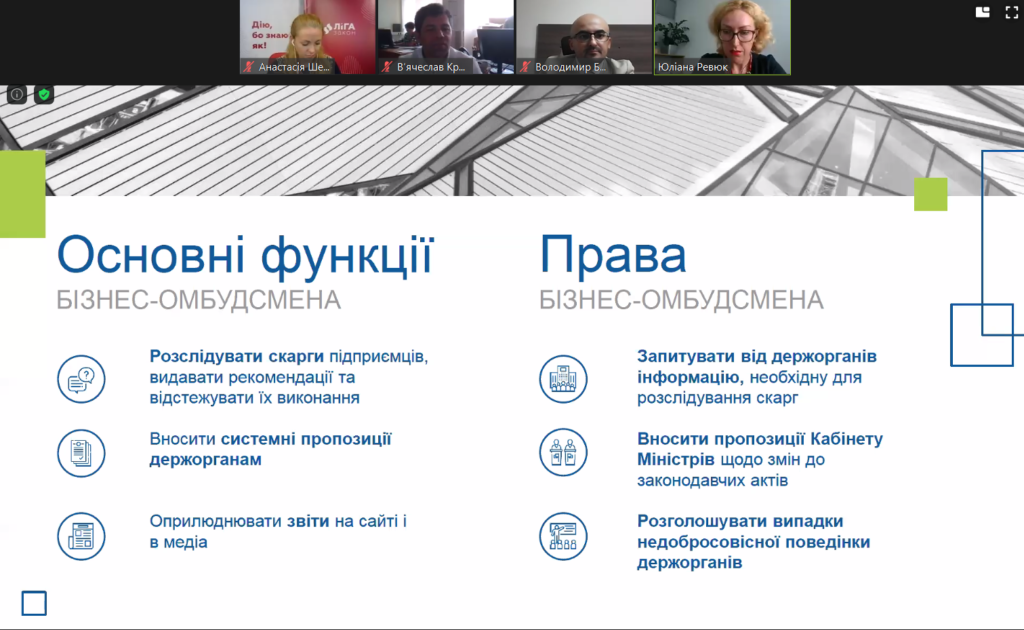

Inspector of the Business Ombudsman Council Yuliana Revyuk told the participants about the powers of the Business Ombudsman and the Business Ombudsman Council and activities in the field of appealing against actions and decisions of tax authorities.

Deputy Head of the Transfer Pricing Directorate of the Tax Audit Department of the State Tax Service of Ukraine Vyacheslav Kruglyak and the Head of the Transfer Pricing and International Taxation Department of the Office of Large Taxpayers of the State Tax Service of Ukraine Iryna Dudka analyzed practical cases of court cases with transfer pricing, outlining in particular the general trends in decision-making on such cases.

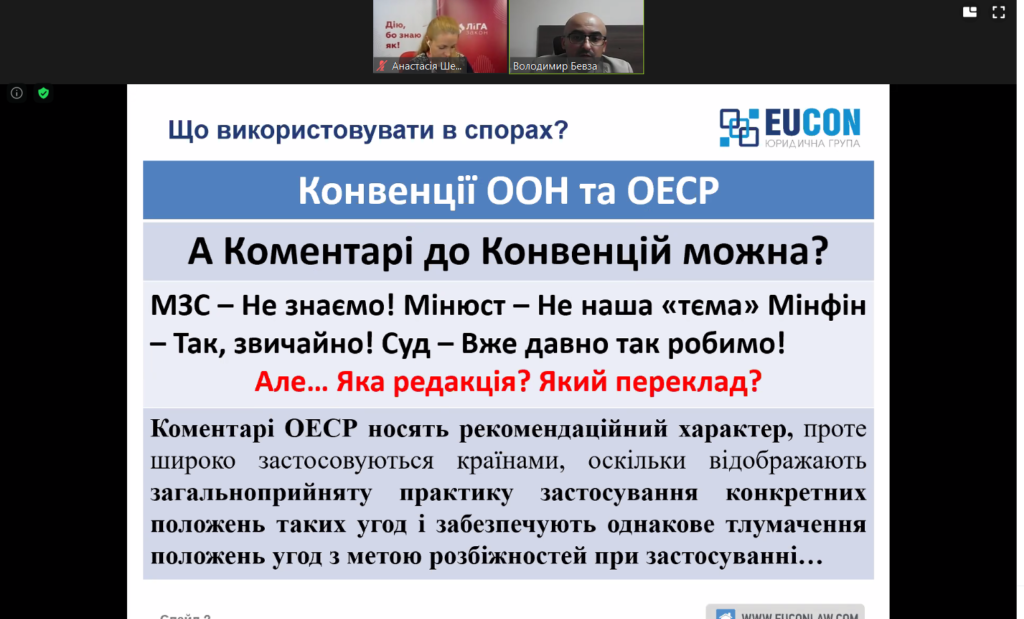

Volodymyr Bevza, Attorney-at-Law, advisor on tax law and transfer pricing of the EUCON Legal Group, closing the forum with his speech under the topic “Position of taxpayers in litigation in transfer pricing. Trends in the latest decisions ”told the participants about the types of disputes in transfer pricing, limitation periods in transfer pricing, disputes about transfer pricing rules, litigation regarding payers‘ mistakes in transfer pricing, court appeals of fines, etc.

The forum participants noted its informativeness, synergistic approach in considering the transfer pricing topic in the context of the views of business representatives, auditors, lawyers and representatives of tax authorities. The high level of preparation for the event in the new online format was also noted. And yet, both speakers and participants expressed their hope for a return to the format of „live communication“ next year in anticipation of the VII International Forum „Transfer Pricing and International Taxation – 2021“!