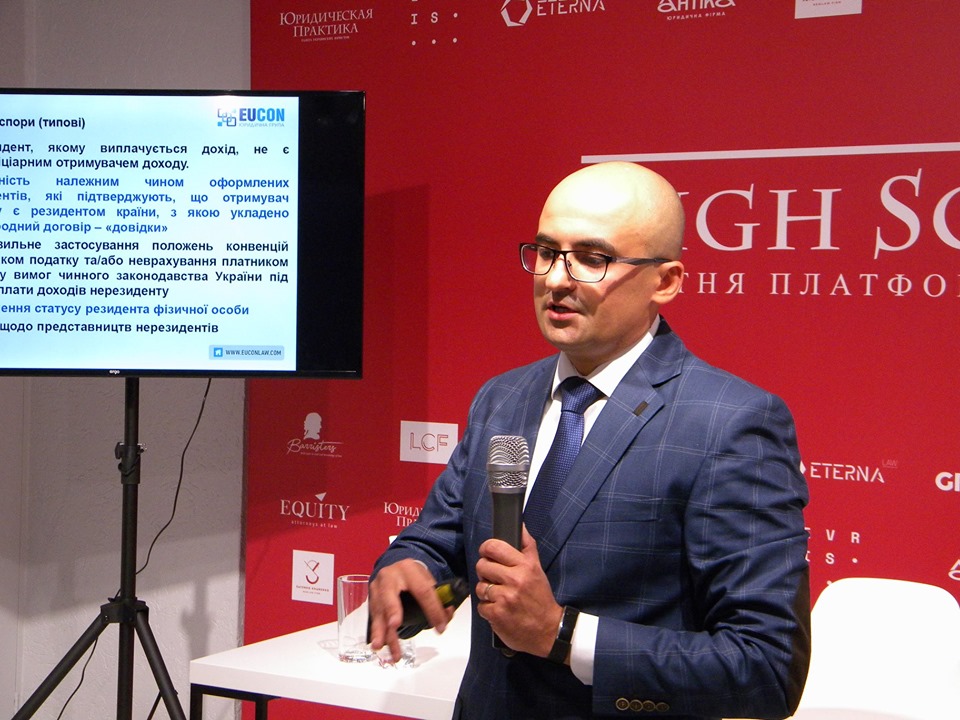

With the advent of the new academic year, not only pupils and students, but also participants of the Legal High School have returned to classes and lectures. Thus, within the module “Taxation of foreign assets” on the topic “Disputes on income of non-residents” was made by an attorney-at-law, deputy head of the court practice of EUCON Legal Group, Volodymyr Bevza.

The expert spoke about the nuances of case law on the income of non-residents, gave examples from the practice of national courts, focusing on the positions of the Supreme Court, but made the reservation that decisions of the Supreme Court of Ukraine and the Supreme Administrative Court of Ukraine can also be studied for informational purposes.

Volodymyr emphasized that it is very important to study not only the essence of the decisions made, but also the procedures applied by the tax authorities before making them. For example, the national court practice indicates that tax authorities act in favor of taxpayers if fiscal procedures are found to be irregular in obtaining tax information.

Courts also decide in favor of the taxpayer if the tax authority’s decision was made in the absence of certain documents or data during the audit (for example, the counterparty’s residency certificate), but such evidence was filed during the trial by the taxpayer. Moreover, national courts are increasingly deciding in favor of taxpayers when there is ambiguity in the provisions of tax laws and motivate their decisions with the priority of international law norms.