September 24 was a productive day for the team of EUCON Legal Group: while colleagues took part in the XII International Forum “Polish-Ukrainian Business Days”, Larysa Vrublevska, auditor, partner, head of transfer pricing practice, once again became a lecturer at the seminar of the Association of Taxpayers of Ukraine.

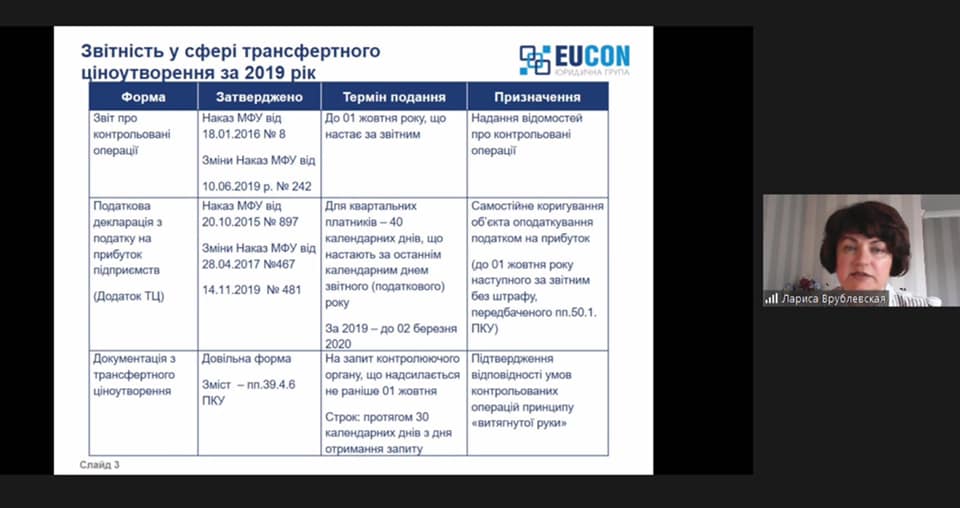

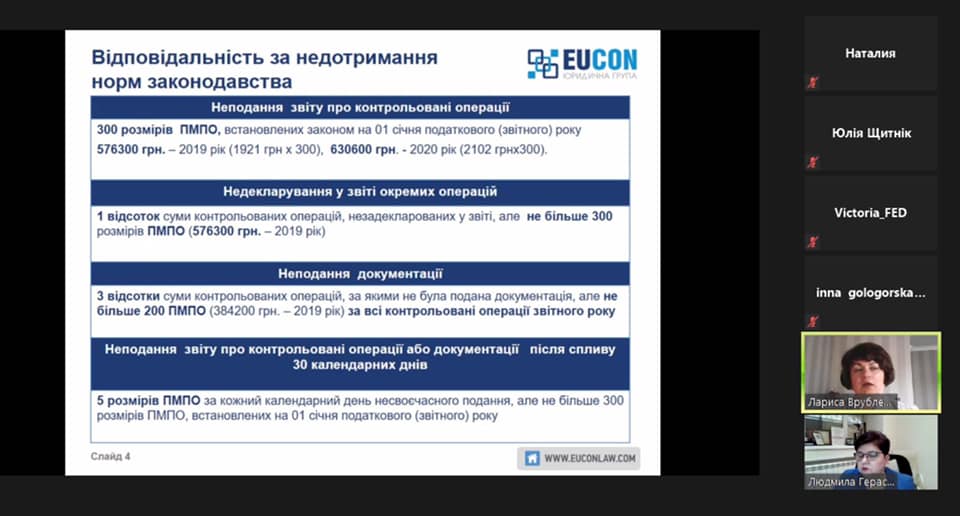

Within the topic “Main aspects of transfer pricing reporting for 2019” Ms. Vrublevska told online listeners about the legislative changes in the field of TP, adopted in 2020, features of preparation and reporting requirements for 2019, liability for non-compliance the norms of legislation, on the peculiarities of correction and self-adjustment procedures, as well as the terms of payment of the tax liability based on the results of self-adjustment.

Additionally, the expert considered the list of controlled transactions in 2019, the cost criterion, business transactions between the non-resident and his permanent establishment in Ukraine, calculation of the volume of transactions with the counterparty and the cost criterion, the procedure for applying the list №480 in 2019.

Also, Ms. Vrublevska told about one of the most important issues in the context of TP – the transfer pricing documentation: requirements to the documentation, the list, features of preparation of documentation, etc.

The expert, of course, could not ignore the question of the need for segmentation of financial statements, giving as an example practical cases of segmentation of financial statements.

The last part of the speech concerned the issues of control and monitoring in the field of transfer pricing, analysis of documentation, as well as inspections.