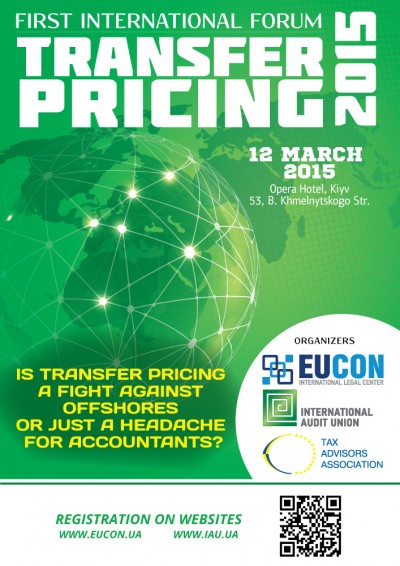

The growing interest toward innovation on transfer pricing (hereinafter – TP) on the part of domestic business and experts has become a prerequisite for the I International Forum “TRANSFER PRICING – 2015” which was held on March 12, 2015 in one of hotels in the capital city and will become an annual event in the future.

Forum was organized by the International Legal Center EUCON, International Audit Union and the Tax Advisors Association with the support of several other organizations.

Experts in the field of tax and corporate law discussed not only problematic and important TP issues, but focused on the practical aspects that shall to be considered when planning and implementing business operations, adjusting of contract prices, filing reports, etc.

According to Yaroslav Romanchuk, managing partner of International Legal Center EUCON, president of the Tax Advisors Association, the significant reduction in cost criteria for transactions that are recognized as controlled automatically expands range of companies who have to submit TP reports. But, unfortunately many taxpayers do not know about this. The earlier TP requirements applied to companies carrying out business transactions with one counterparty for an amount exceeding UAH 50 million. From January 1, 2015 the transactions are deemed to be controlled if the amount exceeding UAH 1 million (or 3% of annual income) for the taxpayer’s with annual revenue up to UAH 20 million.

Representatives of the State Fiscal Service of Ukraine, who lead the TP methodology and control division – Mykola Mishyn and Oleksii Zadorozhnyi mentioned that positive innovation was the abolition of transactions that falls under TP control between residents of Ukraine, they also paid attention to the day-to-day issues regarding report drafting and mistakes that should be considered to avoid penalties and reduce the probability for carrying out tax inspection by controlling body in the company.

Auditor, partner of the International Legal Center EUCON Larysa Vrublevska talked about the ways on how to mitigate risks and optimize tax strategy of the company being under the TP control. Pre-tax planning, training of the staff and adaptation of internal regulations control for TP purpose is only a part of such measures, and its use depends on the sphere of company’s activity.

Also the practice of TP rules implementation in Poland, the Czech Republic, Cyprus, and Belarus were discussed during the Forum.

Programme of the Forum