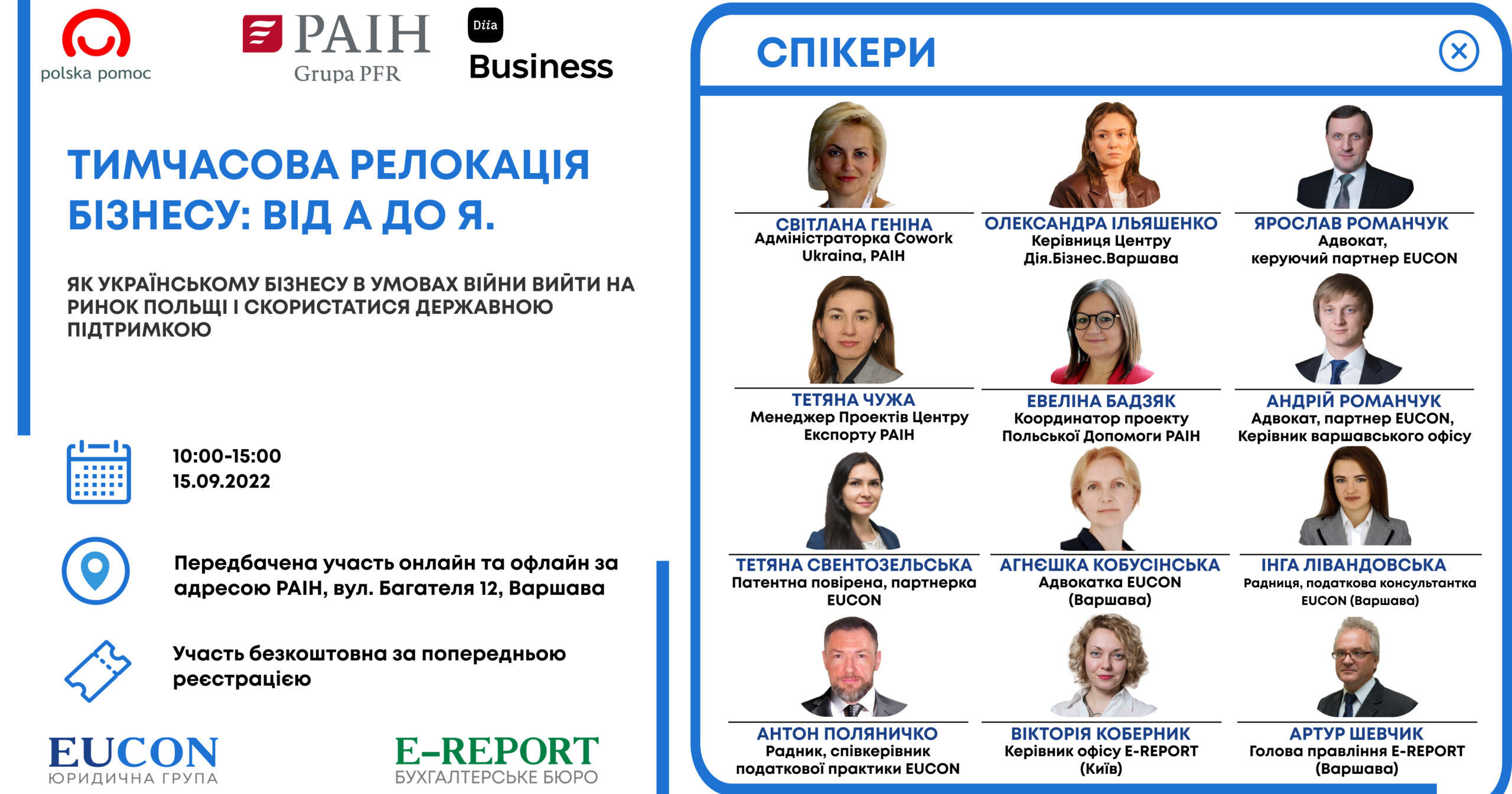

On September 15, another practical seminar “Temporary relocation of business from A to Z: how to enter the Polish market and take advantage of state support for Ukrainian businesses in wartime” was held on the premises of PAIH in Warsaw. The event was organized by the Polish Investment and Trade Agency (PAIH) and the consulting center of the Ministry of Digital Transformation of Ukraine Diia.Business.Warszawa, EUCON Legal Group, and E-Report Accounting Bureau became professional partners of the seminar.

The event was opened with welcoming words from the organizers. Moderator of the meeting and administrator of Cowork Ukraina, PAIH Svitlana Genina outlined this seminar’s content and purpose, which is particularly important in the context of the growing need to support Ukrainian businesses relocated to Poland. The head of the DiIa.Biznes.Warsaw Center Oleksandra Ilyashenko, after welcoming the participants, emphasized the importance of events that meet the current demand and shared information about the organization’s activities in supporting Ukrainian entrepreneurs in Poland. Attorney, managing partner of EUCON Yaroslav Romanchuk, for his part, outlined the vectors of activity of the Association of Ukrainian Business in Poland, which provides support not only to entrepreneurs, but also to Ukrainian students studying at Polish universities, and since the first days of the full-scale war in Ukraine, has been collecting and transportation of humanitarian aid, and also organizes Ukrainian business in Poland to help adapt to the Polish market. Diia.Business.Warszawa center consultant Victoria Bulgakova noted that 90% of the consultations provided by the organization are related to opening a business in Poland, which indicates that the relocated Ukrainian entrepreneurs have adapted and are ready to resume their activities, so such measures are extremely necessary to support Ukrainian business on Polish territories.

The block “State support of Poland and the offer of PAIT for Ukrainian business” began with the speech of the project manager of the PAIT Export Center Tetyana Chuzha, who told the audience about the support tools for Ukrainians from PAIH in Poland. Ms. Tetiana explained in detail the complementary offer of the PFR Group, talking about the structure of the Group and the opportunities provided by the various structures included in the PFR. The expert outlined the geography of activity and tasks of PAIH as a partner in international business and listed the proposals of the business structure through the prism of three key pillars – export, investment and partnership, and also focused on the services that the Kyiv branch, temporarily evacuated to Warsaw, provides to Polish investors, interested in entering the Ukrainian market. The speaker dwelt in detail on measures to support Ukrainian business in Poland, aimed at the development of Polish-Ukrainian partnership, in particular, measures in response to Russia’s military aggression, as well as free co-working for Ukrainians in the PAIH premises.

The next floor was taken by Artem Karvan from the PAIH Investment Center, Poland Business Harbor, who outlined PAIH’s activities in providing free support to investors in Poland in all areas, presented the Center’s portfolio and talked about successfully implemented cases, provided basic information about the business services sector (BSS), supporting what was said with actual statistics. Moving on to the analysis of the IT pool, Mr. Artem presented the geography of employment of IT specialists in Poland, in particular, according to the speaker, each city employs more than 10,000 specialists, and the major program centers are Warsaw, Krakow, Wroclaw, Katowice, Poznan, Gdansk. The expert spoke in detail about the conditions of participation in the Poland Business Harbor program. Yes, under the program, the following are available: an accelerated visa procedure, the labor market (easier access), the possibility of opening and running a private business, support and development programs for selected startups. It is important to note that all benefits also apply to family members of program participants. Artem Karvan also noted that the program was created in cooperation with the Prime Minister’s Office, the Ministry of Development and Technology, the Ministry of Foreign Affairs, PARP, PAIH and SHP and is dedicated to three target groups, namely IT specialists, technology startups, SMEs and large enterprises. The speaker explained exactly how the program can be used, shared statistics on successfully implemented cases within the program, explained with examples what exactly makes the Polish market attractive, and finally outlined state aid programs and EU funds in Poland, in particular, investment incentives and support for scientific research and technological projects.

In the next block “Methods of business relocation to Poland, the legal procedure of transferring or creating a company”, Yaroslav Romanchuk spoke in detail about the stages, methods (registration of a new company, representation, redomicilation), costs, consequences, advantages and disadvantages of business relocation (through the prism of each of methods). Mr. Yaroslav also focused on the advantages of the Polish market for foreign investors (special economic zones, industrial and technological parks, state grants, structural programs, access to financial resources, state export crediting, cheap bank loans, certain tax benefits) and on each of the types of legal forms of doing business in Poland, in particular on their advantages and disadvantages. The speaker talked about the activities of the Ukrainian Business Hub in Warsaw and the range of services and opportunities that the hub provides to Ukrainian entrepreneurs. Yes, the hub meets business needs to optimize time and resources, as entrepreneurs can get all the services they need in one place.

Attorney, partner of EUCON, head of the Warsaw office Andrii Romanchuk added that when choosing a way to enter the Polish market, it is necessary to do preliminary “homework” by making a deep business analysis, in particular, due diligence. It is also extremely important to have a good credit history and to take into account the two most common mistakes and problems when entering the Polish market: 1) the lack of an owner in place; 2) at the initial stages, the owners do not always feel the difference in mentality and approaches to the ways of doing business.

Later, during the block “Tax system and tax accounting in Poland”, Yaroslav Romanchuk listed the main tax rates in Poland, outlined the realities of the tax payment process by legal entities in Poland (in the context of the type of legal form of doing business), talked about the functioning of the Convention on the Avoidance of Double Taxation and its features, in particular about the features of paying taxes in the context of residency, declaring income received abroad. The speaker did not miss the issue of taxation through the prism of the implemented BEPS plan and its consequences. Also important is the point regarding the categories of taxpayers in Poland, as well as the start of the operation of the CRS system in Ukraine and the extension of the tax amnesty period.

Anton Polyanychko, PhD, attorney, adviser, co-head of EUCON’s tax practice, continued the given topic, who talked about the consequences for Ukrainians who are forced or knowingly staying abroad for more than 183 days, regarding tax residency. Thus, the speaker named the conditions under which it is necessary to acquire Polish tax residency and under which it is possible to maintain Ukrainian residency, answered questions about whether it is possible to have two residencies at once, how to avoid tax risks, explained all the necessary information about the terms of stay abroad, characterized peculiarities of Ukrainian and Polish tax legislation, etc.

The seminar continued with a speech by Andrii Romanchuk on the topic “Financial support and financial instruments for business in Poland”. According to the data provided by the speaker, during 2014-2020, Poland became the most successful beneficiary of funding from EU funds, which were effectively used for the development of various sectors of the economy. According to the speaker, attention should be paid to the possibility of using financial instruments in Poland in the context of the planned EU allocation of 160 billion euros during 2021-2027, of which 125 billion will be allocated for additional financing, and 35 billion. – for loans. Next, the listeners had the opportunity to learn more about the factors that make the Polish market attractive for foreign investors, as well as about seven types of financing. Equally important among the discussed issues are the types of sources of funding for entrepreneurial activity and the list of the most common problems encountered by startups when conducting business in Poland and when using financial instruments. Concluding his speech, Andrii Romanchuk provided statistics on the value of investments and their distribution, and also spoke about the features of opening accounts in Polish banks (requirements, opening procedures, management).

Councilor, EUCON tax consultant Inha Livandovska, speaking on the topic “Issues of migration and labor law. How to get the right to reside in Poland, taking into account the latest legislative changes”, focused on aspects of the grounds for legal stay in Poland, including visa-free regime, visa, card, as well as acquiring one of the statuses – temporary protection or refugee, talking about the features of each on grounds, validity periods of documents, pitfalls, risks, mechanisms for obtaining documents and statuses and the circle of persons who can use the mObywatel application and the Diia.pl document. The speaker emphasized the need to carefully analyze one’s own needs and future plans for planning and preparing the necessary documents for legalizing one’s stay in Poland in the most optimal status for a specific person, and also noted that Ukrainians who received the status of temporary entry can now leave Poland without risks of loss of status. Ms. Inga also told the participants about the amendments to the Law “On assistance to citizens of Ukraine in connection with the armed conflict on the territory of Ukraine” adopted in July 2022 and some other changes. At the end of her speech on this topic, the expert considered the issue of legalization of stay in Poland for the purpose of employment, methods, necessary conditions and documents required for this.

Next, Ms. Inga moved on to the topic “Acquisition of ownership of real estate by individuals and legal entities.” Within the scope of the topic, the speaker analyzed the items related to the acquisition of property rights by foreigners, as well as the acquisition or acquisition by a foreigner of shares in companies that have real estate in Poland, as well as the necessary permission of the Minister competent for internal affairs, to obtain which the foreigner must apply for the relevant application. The lawyer outlined the content of two possible conditions for issuing a permit at the request of a foreigner and their features. Inga Livandowska emphasized that it is important to take into account the aspect of the area of real estate purchased by foreigners 1) for the purpose of satisfying their own life needs, 2) for the purpose of carrying out economic or agricultural activities in Poland. The participants also received the necessary information regarding the purchase of real estate by a company in which foreigners are co-owners, and the purchase or acquisition of shares in companies located in Poland that own real estate. As the speaker emphasized, another important point is that non-compliance with the restriction or the absence of the necessary permission leads to the invalidity of the real estate transaction.

Patent lawyer, EUCON partner Tetyana Sventozelska spoke next to the participants. Within the framework of the topic “Peculiarities of the use of objects of intellectual property rights during relocation to Poland”, the expert first of all explained the definition of intellectual property and what exactly is attributed to it, named the main types of objects of IP rights: trademarks (names, logos); inventions (useful models) – devices (or products), methods; industrial samples (product appearance, design); literary and artistic works, computer programs, in particular images of heroes, databases, etc.; commercial (brand) names; geographical indications of origin of goods. Next, Ms. Tetiana focused in more detail on the point of defining a trademark, methods of its protection, named two methods of TM registration abroad: a) submit an application directly to the Office of the necessary countries, for example, to the Office of the European Union; b) apply to the Madrid System of International Trademark Registration. The patent attorney spoke in detail about the definition of an invention (utility model), methods of registering an invention in other countries, emphasizing the fact that patents are territorially limited. It is also important that the industrial design is protected by the law of the country in which it is registered. At the end of her speech, Ms. Tetiana voiced possible options for copyright protection.

The last speech of the seminar was a joint speech by Artur Shevchyk, the head of the Management Board of the E-REPORT accounting bureau, and Victoria Kobernyk, the head of the E-REPORT office in Kyiv, on the topic “Accounting and tax accounting in Poland, practical aspects of business relocation.” Mr. Artur and Ms. Victoria began by describing the activities of the accounting bureau “E-REPORT”, in particular, they noted that the bureau provides the following services: subscriber service, accounting and tax accounting outsourcing; verification of financial and economic activity; audit and related services. The speakers talked about the specifics of the company’s activities in Poland and Ukraine, explained the difference in Ukrainian and Polish tax legislation, gave sound advice on what the client should do when relocating, namely: 1) conduct business in accordance with current legislation; 2) submit complete, ordered primary accounting documents in a timely manner in accordance with the provided instructions; 3) always consult with the accounting department regarding your activities; 4) inform about all changes in the company’s activities. According to experts, the most frequent mistakes of clients are: 1) untimely submission of documents; 2) intuitive management of accounting activities; 3) mistrust of accounting; 4) lack of communication. The main message of Mr. Artur’s and Ms. Victoria’s speech was the idea that lack of order in accounting can cause not only loss of earnings, but also fines from regulatory authorities.

In the final part of the event, the speakers answered all the questions raised by the participants, and also noted the importance of continuing the dialogue in a similar format for the support of Ukrainian business in Poland and the development of Polish-Ukrainian business partnership.