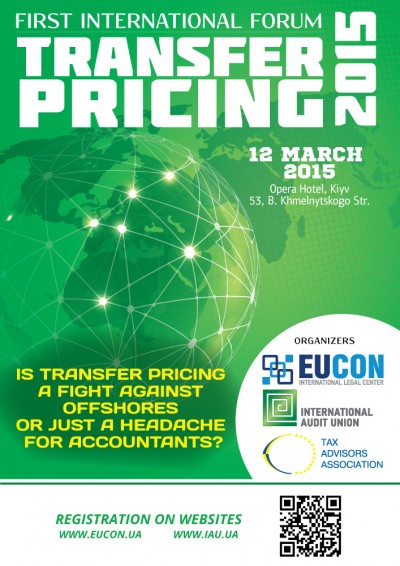

The growing interest toward innovation on transfer pricing (hereinafter – TP) on the part of domestic business and experts has become a prerequisite for the I International Forum “TRANSFER PRICING – 2015” which was held on March 12, 2015 in one of hotels in the capital city and will become an annual event in the future.

Forum was organized by the International Legal Center EUCON, International Audit Union and the Tax Advisors Association with the support of several other organizations.

Experts in the field of tax and corporate law discussed not only problematic and important TP issues, but focused on the practical aspects that shall to be considered when planning and implementing business operations, adjusting of contract prices, filing reports, etc.

According to Yaroslav Romanchuk, managing partner of International Legal Center EUCON, president of the Tax Advisors Association, the significant reduction in cost criteria for transactions that are recognized as controlled automatically expands range of companies who have to submit TP reports. But, unfortunately many taxpayers do not know about this. The earlier TP requirements applied to companies carrying out business transactions with one counterparty for an amount exceeding UAH 50 million. From January 1, 2015 the transactions are deemed to be controlled if the amount exceeding UAH 1 million (or 3% of annual income) for the taxpayer’s with annual revenue up to UAH 20 million.

Representatives of the State Fiscal Service of Ukraine, who lead the TP methodology and control division – Mykola Mishyn and Oleksii Zadorozhnyi mentioned that positive innovation was the abolition of transactions that falls under TP control between residents of Ukraine, they also paid attention to the day-to-day issues regarding report drafting and mistakes that should be considered to avoid penalties and reduce the probability for carrying out tax inspection by controlling body in the company.

Auditor, partner of the International Legal Center EUCON Larysa Vrublevska talked about the ways on how to mitigate risks and optimize tax strategy of the company being under the TP control. Pre-tax planning, training of the staff and adaptation of internal regulations control for TP purpose is only a part of such measures, and its use depends on the sphere of company’s activity.

People’s deputy of Ukraine, Deputy Head of the Verkhovna Rada of Ukraine Committee on Taxation and Customs Policy Mr. Andrii Zhurzhii emphasized that the issue of recognizing transactions as controlled is very important. Therefore, the Draft Law №1861 which provides dispute settlement provisions in the procedure of cost criterion calculation when determining the transactions as controlled, and the list of controlled transactions to be monitored, has been registered in the Parliament of Ukraine.

Member of the UN Committee of Experts on International Cooperation in Tax Matters Mr. Ulvi Yusifov spoke about the global tendencies in application of transfer pricing rules and other aspects of transfer pricing under the BEPS project. The BEPS project has put transfer pricing at center stage and will require more effort to support positions taken.

Director of “Ukrpromzovnishexpertyza” state enterprise, Mr. Volodymyr Vlasiuk talked about the use of information sources on market prices for transfer pricing purposes. He advised to work with independent periodicals, including international ones, because getting information from other market participants is almost impossible. He also noted that the world’s leading publications tend to use two basic principles of information display: operations on the open market between unrelated parties, impartiality and coverage of a large number of market participants.

Also the practice of TP rules implementation in Poland, the Czech Republic, Cyprus, and Belarus were discussed during the Forum.

Photo are available HERE.

Programme of the Forum