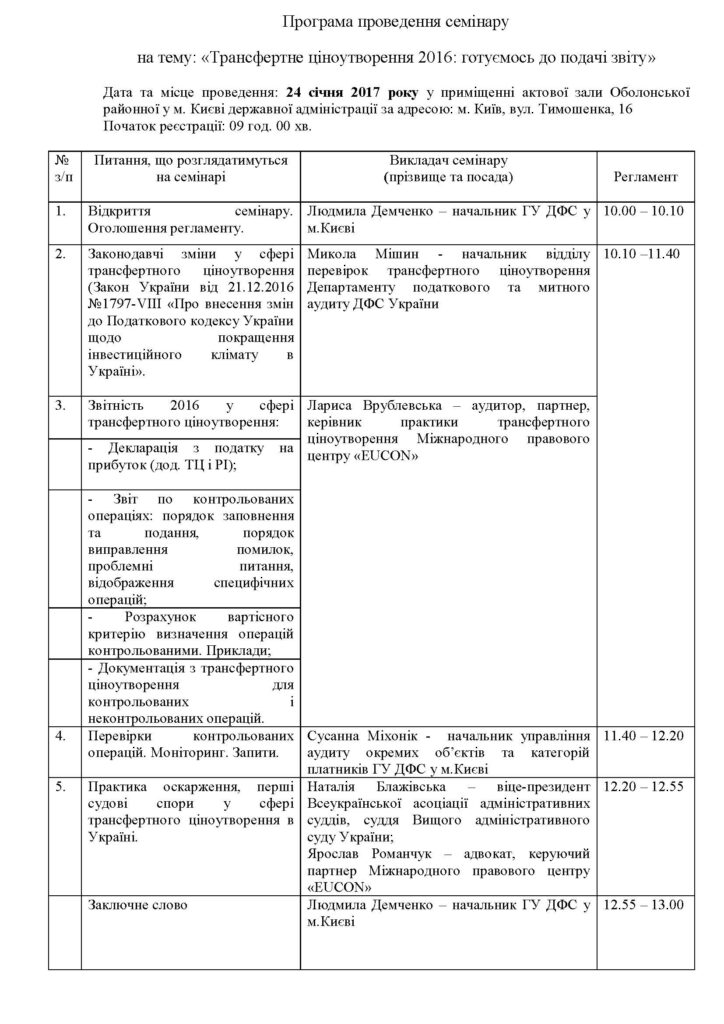

The Center Department of the State Fiscal Service of Ukraine in Kyiv held a large-scale seminar on transfer pricing (TP) for taxpayers. Indoors of Obolon District State Administration in Kyiv hosted the event on January 24, 2017 and brought together more than 200 participants.

The Center Department of the State Fiscal Service of Ukraine in Kyiv invited representatives of the International Legal Center EUCON – Larysa Vrublevska (auditor, Partner, Head of the Transfer Pricing practice) and Yaroslav Romanchuk (lawyer, Managing Partner) – to join the speakers of the event. From the side of the tax authorities the seminar was attended by the Deputy Head of State Fiscal Service of Ukraine in Kyiv Volodymyr Varhich, the Deputy Head of Inspections Division on Transfer Pricing at Tax and Customs Audit Department of the State Fiscal Service of Ukraine Vyacheslav Kruhliak, Head of the Audit Department for certain categories of payers and objects at the Center Department of the State Fiscal Service of Ukraine in Kyiv Susanna Mykhonik.

Larysa Vrublevska spoke of the practical aspects of preparing TP reports and documentation in 2016. Having described the nuances of each reporting form, she focused on the large gaps between the submission terms. Henceforward a report on controlled transactions must be submitted until October 1 of the year following the reporting year (instead of May 1), and the income tax declaration until February 9. Thus, all the calculations are to be done in advance. In practice, it is almost impossible to achieve and fines may follow as a result. Larysa Vrublevska drew attention to the fact that having extended the submission deadlines, the legislator did not change the related rules. For example, requests for documentation are still to be sent after May 1. Such conflicting norms require amendments.

Yaroslav Romanchuk told about the first TP cases in courts. He also mentioned that the International Legal Center EUCON team initiated a review of orders by the Cabinet of Ministers of Ukraine of 12.25.2013 № 1042 and № 449-p of 05.14.2015 on improper inclusion of Switzerland to the list of states with income tax rate by 5 or more percentage points lower than in Ukraine.

“Taxpayers conducting business transactions with the residents of Switzerland, who felt an unreasonable and illegal control over their TP now have a real opportunity to restore their rights in court and we are ready to help them” – said Yaroslav Romanchuk.