Yaroslav Romanchuk, attorney at law, managing partner, head of tax practice at EUCON Kyiv office, and Inha Livandovska, advisor, tax consultant, head of tax practice at EUCON Warsaw office, were speakers at the conference „How to pay taxes in Europe?“.

The conference was held on 20-21 October and was organised by the renowned economist Mykhailo Kukhar and Liya Smekun, Founder of Medical Business Forum and WEEKLY Economic Monitor by Ukraine Economic Outlook.

During their speech, EUCON experts told the conference participants when foreigners have to pay taxes in Poland, whether Ukrainian sole proprietors located in Poland and operating in Ukraine are obliged to pay taxes, what taxes in Poland are paid by individuals, what are the tax rates for JDGs (sole proprietors) and legal entities and many other important issues related to taxation in Poland.

In his speech, Yaroslav Romanchuk noted that there are currently about 1.6 million Ukrainians legally residing in Poland. In 2022, Ukrainians registered 29.4 thousand sole proprietorships (JDGs) and there are 24.1 thousand companies with Ukrainian capital operating in Poland. About 50,000 Ukrainian students study in Poland, Ukrainian specialists make up a very large group of expats, and Ukrainians, compared to all foreigners, make up the largest share of real estate purchases in this country.

„All of these categories are obliged or may become subject to paying taxes in Poland, so every Ukrainian who is in this country should be aware and find out whether he or she is a tax resident of Poland to avoid possible tax risks,“ Yaroslav Romanchuk emphasised.

Yaroslav also pointed out that the Polish tax authorities use among others the Convention for the Avoidance of Double Taxation, including the OECD Model Convention and EU Directives, in their work on taxation of foreigners. „In particular, with regard to the taxation of Ukrainian individual entrepreneurs, the tax authorities often use the Model Convention,“ said Yaroslav.

Inha Livandovska emphasised in her speech that under Polish law only persons who have the appropriate qualification of a tax consultant and are included in the register of such consultants are entitled to provide tax advice. Failure to comply with these requirements, especially by accountants, is subject to liability and significant financial penalties.

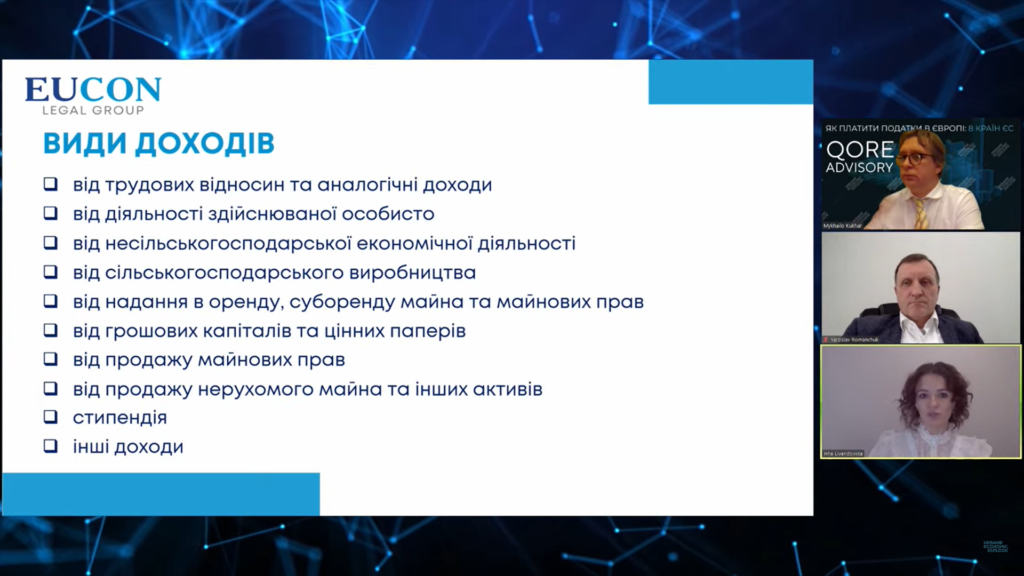

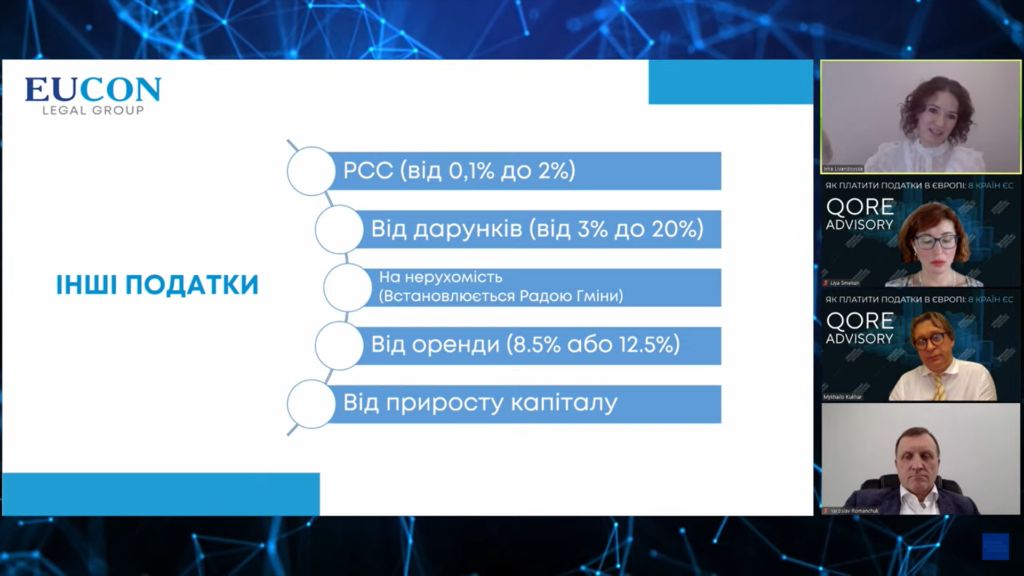

Inha Livandovska also touched upon the issue of tax rates for natural persons, JDG (sole proprietorships), legal entities, tax rates from civil actions (PCC), real estate tax, etc.

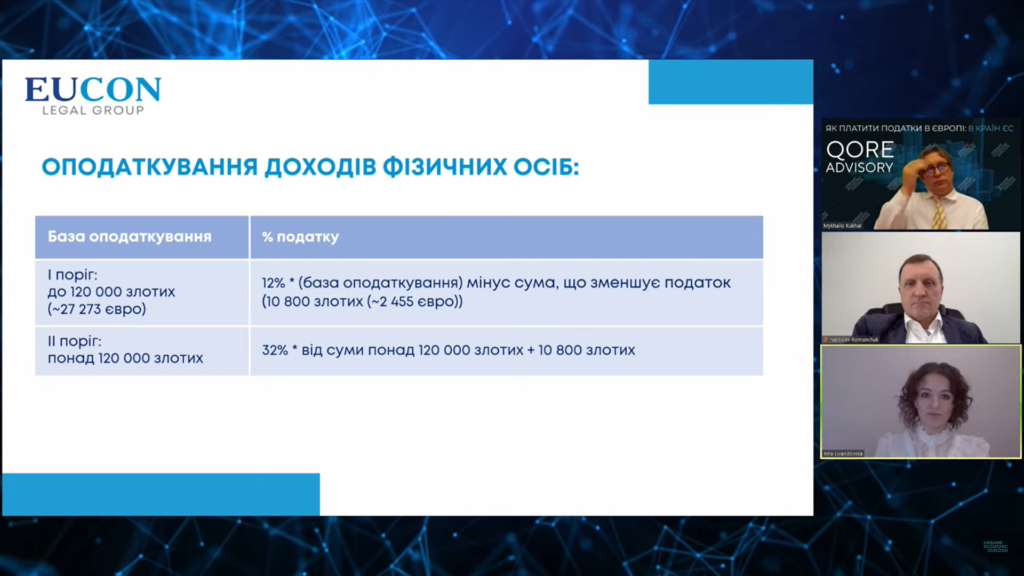

Regarding the taxation of natural persons, Inha Livandovska emphasised that in Poland, every individual is obliged to declare and pay tax on income received in the previous year by the end of April. The personal income tax rate is 12% or 32%, depending on the level of income received during the year.

Regarding the taxation of JDGs, Inha explained that there are three forms of taxation in Poland: a tax scale (12% up to PLN 120,000 per year and 32% above PLN 120,000 per year), a unified tax (19%) and a fixed tax amount that varies from 2% to 17% depending on the type of activity. She pointed out that sole proprietors are obliged to pay social security and health insurance contributions. While the social security contribution is fixed, the health insurance contribution depends on the chosen form of taxation.

Among the next issues to be addressed during the event was the issue of VAT payment and VAT registration. „Whether you have to be a VAT registered payer depends on the type of your business and the amount of income you receive during the year. A VAT payer can be either a legal entity or a JDG (sole proprietorship). The basic VAT rate in Poland is 23%, but there are certain goods and services that are subject to special VAT rates,“ said Inha Livandovska.

Inha Livandovska also provided information on corporate income tax (CIT), noting that the basic tax rate is 19%, and there is a preferential rate of 9% if the annual income does not exceed EUR 2 million.

At the end of their presentation, the experts reviewed practical cases of taxation in Poland.

In total, during the two days of the conference, the participants learnt about taxation options in 8 European countries, namely: Germany, Spain, France, Poland, Turkey, Switzerland, Belgium and Bulgaria.