Перейти на личности

Ярослав Романчук и Евгений Петренко уверены в том, что пока в законодательство не введут персональную ответственность должностных лиц государственных органов, все чиновники будут чувствовать себя безнаказанными. По мнению Ярослава Романчука (слева) и Евгения Петренко, действия некоторых представителей государственных органов не способствуют повышению имиджа Украины и инвестиционной привлекательности нашего государства На протяжении всего года общественность наблюдала за судебными [:]

У вас все хорошо?! Только до поры до времени. Уголовная ответственность должностных лиц. Тенденции судебной практики

Работа директора и бухгалтера на предприятии довольно ответственная, сложная, и в реалиях нашей жизни – опасная, ведь из-за своих ошибок и просчетов проблемы могут возникнуть не только у предприятия, но и у самих должностных лиц – в виде привлечения к уголовной ответственности. Кто и за что отвечает? Немного статистики Складывается впечатление, что в понимании правоохранительных [:]

Large-scale seminar on transfer pricing in 2017 took place in Kyiv

The Center Department of the State Fiscal Service of Ukraine in Kyiv held a large-scale seminar on transfer pricing (TP) for taxpayers. Indoors of Obolon District State Administration in Kyiv hosted the event on January 24, 2017 and brought together more than 200 participants. The Center Department of the State Fiscal Service of Ukraine in [:]

Costly mistakes

Given the rise in the exchange rate in recent years, the number of taxpayers engaged in foreign economic operations, which are controlled in terms of transfer pricing, is growing steadily. Based on the information of the DFSU, about 3,000 companies submitted a report on controlled transactions for 2015. At the same time, quite a number [:]

Transfer pricing: error in calculation of cost criterion — according to sum of fine

In the event of detection of failure to submit or untimely submission of reporting on controlled operations, a company will receive a fine in the amount of 300 minimum wages set as of 1 January of the reporting year. The amount of such fine for failing to submit reporting in 2015 was UAH 365,400; in [:]

Measures for de-offshorization in Ukraine

The fight against offshores intensified around the world after the 2008 financial crisis. The main focus was on combating tax evasion, exchange of tax and financial information, transparency and the disclosure of beneficiaries. According to Yaroslav Romanchuk, managing partner of International Legal CenterEUCON, the major initiatives on de-offshorization at international community level are measures for [:]

Latest changes in TP legislation discussed at the II Agrarian Tax Conference

On December 9, 2016, Larysa Vrublevska, partner, Head of Transfer Pricing at EUCON International Legal Center took part in the II Agrarian Tax Conference. The event was organized by ProAgro information company. Larysa spoke in the first block with the report on “Transfer pricing: preparation of reports and control of tax risks”. During her speech, [:]

Handling of complaints by the State Fiscal Service authorities became transparent

Handling of taxpayers’ complaints under the procedures of administrative appeal of tax notice-decisions by the State Fiscal Service can now be open, transparent and conducted with the mass media participation.

Three reasons to invest in Poland to reach the EU market

Kyiv hosted an international forum “Polish Business Day” to cover practical steps of doing business in Poland and the state of Ukraine-Poland economic cooperation UT visited the forum “Polish Business Day” which is a communication platform for Polish and Ukrainian business to exchange experience, look for new opportunities for investments and find common ground among [:]

Three main reasons to invest in Poland to reach the EU market

Kyiv hosted an international forum “Polish Business Day” to cover practical steps of doing business in Poland and the state of Ukraine-Poland economic cooperation UT visited the forum “Polish Business Day” which is a communicational platform for Polish and Ukrainian business to exchange experience, look for new opportunities for investments and find a common ground [:]

Результати V Міжнародного форуму “ПОЛЬСЬКИЙ БІЗНЕС ДЕНЬ”

24 листопада 2016 року у Києві відбувся черговий V Міжнародний форум «ПОЛЬСЬКИЙ БІЗНЕС ДЕНЬ». Протягом останніх років форум став найбільшим комунікаційним майданчиком для польсько-українського бізнесу та уже встиг зарекомендувати себе як ефективний спосіб обміну досвідом, пошуку нових можливостей для реалізації інвестиційних проектів та налагодження нових контактів з інвесторами, представниками державних та місцевих органів влади, фінансових [:]

The results of the V International Forum “POLISH BUSINESS DAY”

On November 24, 2016 the V International Forum “POLISH BUSINESS DAY” took place in Kyiv. In recent years the forum has become the largest communication platform for Polish-Ukrainian businesses and established itself as an effective way to share experiences,

В Киеве проходит V Международный форум «Польский бизнес-день»

В Киеве проходит V Международный форум «Польский бизнес-день». Мероприятие проходит под патронатом Посольства Республики Польша на Украине при поддержке Министерства экономического развития и торговли Украины. Организаторами форума традиционно выступили Отдел содействия торговли и инвестиций Посольства Республики Польша на Украине, Международный правовой центр EUCON, Международный аудиторский союз, Ассоциация украинского бизнеса в Польше. Открывая мероприятие Бартош Мусялович, [:]

Итоги V Международныого форума “ПОЛЬСКИЙ БИЗНЕС ДЕНЬ”

В течение последних лет форум стал крупнейшей коммуникационной площадкой для польско-украинского бизнеса и уже успел зарекомендовать себя как эффективный способ обмена опытом, поиска новых возможностей для реализации инвестиционных проектов и налаживания новых контактов с инвесторами, представителями государственных и местных органов власти, финансовых институтов, рекрутинговых и консалтинговых компаний. Организаторы: • Отдел содействия торговле и инвестициям Посольства [:]

В Киеве проходит V Международный форум «Польский бизнес-день»

В Киеве проходит V Международный форум «Польский бизнес-день». Мероприятие проходит под патронатом Посольства Республики Польша на Украине при поддержке Министерства экономического развития и торговли Украины. Организаторами форума традиционно выступили Отдел содействия торговли и инвестиций Посольства Республики Польша на Украине, Международный правовой центр EUCON, Международный аудиторский союз, Ассоциация украинского бизнеса в Польше. Открывая мероприятие Бартош Мусялович, [:]

Участники форума обсудили деловую привлекательность городов и регионов Польши

Продолжает свою работу V Международный форум «Польский бизнес-день». «Польша через призму деловой привлекательности городов и регионов» – тема второй сессии форума. Участникам предоставили возможность ознакомиться с аспектами ведения бизнеса в Плоцьке, Гданське, технологическими парками и пр. В рамках третьей сессии спикеры осветлил практические аспекты ведения бизнеса в Польше. В частности, о 10 главных причинах инвестирования [:]

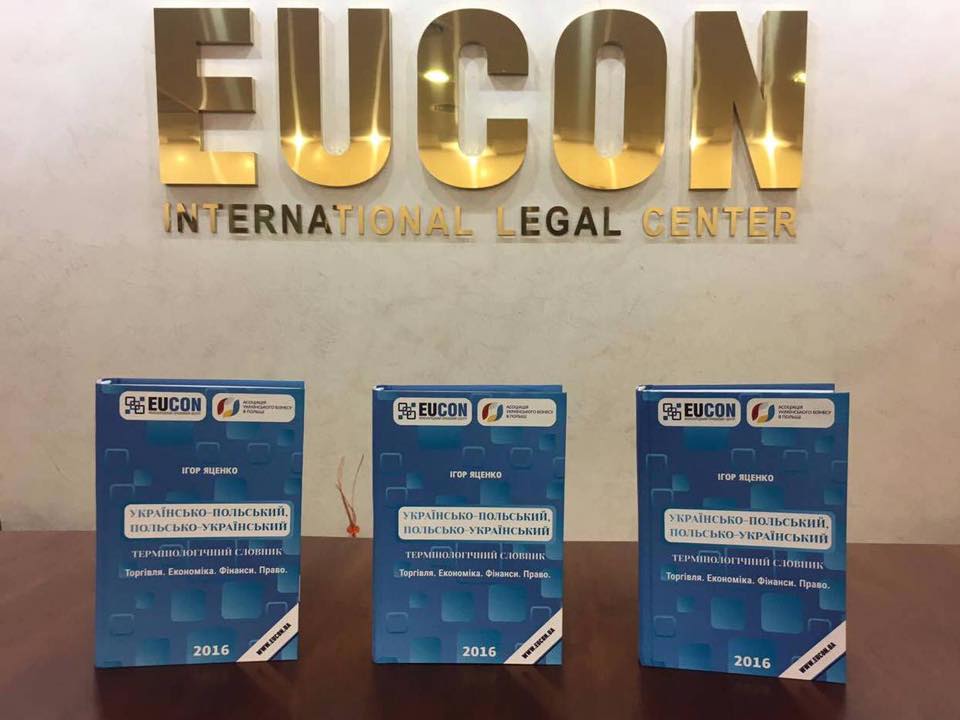

Polish language became closer

The new “Ukrainian-Polish, Polish-Ukrainian terminology dictionary: Trade. Economy. Finance. Law” has been published this autumn. The dictionary includes modern law and business terminology, which is used in trade relations, business and investment activities. More than 45,000 words and phrases in total. The author of the dictionary is an attorney, senior partner, head of the Warsaw office [:]

CONGRESS OF THE POLISH LEAGUE OF UKRAINIAN STUDENTS

On November 17, 2016 the first major event for Ukrainian students studying in Poland – Congress of the Polish League of Ukrainian Students – took place in Warsaw. The event brought together more than 150 participants, among them Ukrainian students from Lublin, Rzeszów, Katowice, Przemysl, Krakow, Gdansk, Lodz, Wroclaw and Warsaw.

INTERNATIONAL FORUM: MIGRATION, WORK AND STUDY ABROAD

INTERNATIONAL FORUM: MIGRATION, WORK AND STUDY ABROAD is getting closer. How to bring the services of intermediaries out of the shadows? How to protect the rights of Ukrainians abroad? Date: 6 April 2017 Time: 09:00-15:00 Venue: Kyiv Regional State Administration, Big Assembly Hall, 1 L.Ukrainky str., Kyiv Organizers: State Employment Service of Ukraine; International Recruiting Group GlobalJobGate; International [:]

ILC EUCON defended the interests of DPD Ukraine (international logistics network) at the Supreme Administrative Court of Ukraine

The decision of the cassation court left the first instance court decision revoking tax notices by Kyiv-Sviatoshyn Tax Inspectorate unchanged. According to the fiscal service authority decision, the total amount of accrued tax liabilities amounted to UAH 5 850 079, 00. Legal support of the case was provided by Volodymyr Bevza, attorney, deputy head of [:]